In the previous flash news we informed you about legislative changes in the tax area that were proposed as part of the consolidation package. The Slovak Parliament approved almost all except for a few changes that we want to inform you about.

Income Tax

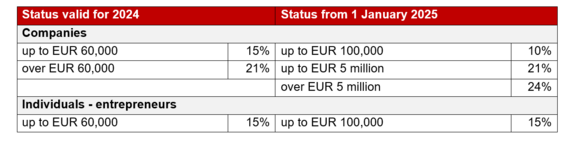

- the second income threshold and tax rate for legal entities has changed from proposed threshold of EUR 1 million and 22% tax rate to threshold of EUR 5 million and 24% tax rate.

- the comparison of current income tax rates you can find in the table below the article.

Regulated industries

- the originally proposed increase in the levy rate for the energy sector (energy producers and distributors) has been cancelled.

- a regulated person will also be considered a person or organizational unit of a foreign person who is authorized to perform activities in the field of pharmacy based on a permit issued by the State Institute for Drug Control (not only a permit issued by the Ministry of Health of the Slovak Republic).