Eat, Sleep, Grow

You probably already know that the three letters ESG stand for Environment, Social, and Governance.

ESG criteria are benchmarks by which companies and investors evaluate their sustainability and ethical responsibility. "Environment" encompasses the use of natural resources, climate protection, and energy efficiency. "Social" refers to fair working conditions, health protection, and social engagement. "Governance" stands for transparent, responsible corporate management that avoids corruption and promotes diversity. ESG investments consider these factors alongside financial aspects to promote sustainable, future-proof business models and secure long-term returns.

Sustainability: as sure as the amen in prayer

Sustainability is another area characterized by dynamic international and national developments and influencing the industry. The auditing profession has been conducting voluntarily audits of sustainability reports or has been commissioned to prepare sustainability reports for many years.

The Corporate Sustainability Reporting Directive (CSRD), which came into force in the European Union (EU) this year, fundamentally changes the scope and nature of (previously voluntary) corporate sustainability reporting. The CSRD requires large companies to report on the impact of their business activities on the environment (including CO2 emissions) and society. This also requires third-party auditing of sustainability reports. An estimated 50,000 companies in the EU are affected by this. Even if the pendulum is now swinging in the other direction and the omnibus appears to be heading in a different direction, the following remains unchanged:

The CSRD now requires significantly more companies than before to report comprehensively and in a standardized manner on their sustainability strategy and environmental, social, and governance issues. Whether you are required to submit a sustainability statement or not, the goal remains unchanged throughout your entire value chain: more transparency, more data, more audit obligations – all in accordance with clear EU standards.

You'll be well-advised to adapt your processes, IT systems, and internal expertise to the requirements of the financial markets early on. Those who act now will not only remain compliant but can also use sustainability as a real competitive advantage. So, roll up your sleeves and contact us. We have a sensible solution.

FALCON ESG QUICK CHECK: It might help you!

"The trickle-down effect is the indirect reporting obligation. This involves passing on the direct reporting obligations to which large companies and banks are subject to smaller companies without direct reporting obligations. This transfer occurs through the disclosure obligations of large companies' value chains or through the management of financing risks by financial service providers." Source: German Chamber of Industry and Commerce in cooperation with Eurochambres and SME United (2023)

The so-called "trickle-down effect" leads to increased demand for sustainability information.

Know what to expect. Surprise your customers and your bank.

We – embedded in an internationally active tax consulting and auditing group – know that banks, especially large customers and suppliers, are increasingly requesting sustainability information from small companies. We have developed a solution for this.

ESG Screening Tool (VSME)

We offer a standardized quick check for BMD. This allows you to measure and track ESG principles in your company with manageable effort. This also enables you to:

standardize the numerous ESG data requests currently required, which represent a significant burden for small businesses,

reduce uncoordinated requests, and ultimately, improve access to (bank) financing in the medium term.

Sustainability reporting for your company, transparent, compliant and compact!

New legal obligations on the way to NETZERO lead to more sustainable corporate management.

As an internationally operating group, we are at your side during this transformation process! With our colleagues at ALLINIAL GLOBAL ® , we also offer cross-border solutions.

ESG Consulting

- There is no business like your business: we help you develop your ESG vision through to your sustainability strategy.

- We work with you in workshops and create awareness at every management level.

- We conduct the double materiality analysis and stakeholder survey with you and handle the evaluation.

- We support you in calculating your corporate carbon footprint (Scope 1, 2 & 3) and provide a TÜV-certified software solution.

- We identify your relevant data points and support you in collecting and consolidating KPIs.

- We are available to your employees for technical questions.

- We help you prepare your sustainability statement.

ESG audit by our AUDIT partner

Our Carbon Footprint 2023

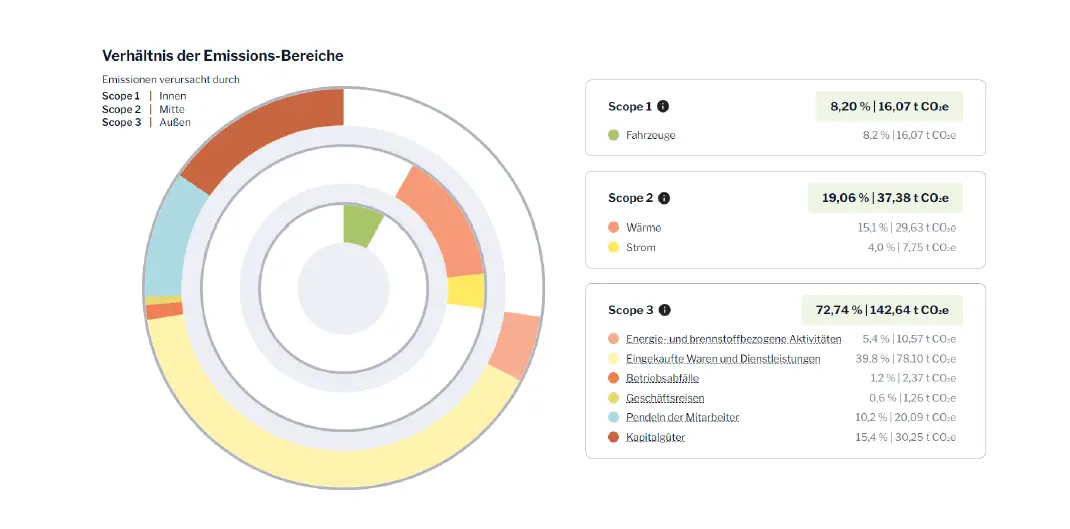

Learn how FAL-CON HOLDING GmbH successfully determined its Corporate Carbon Footprint (CCF) in 2023. Transparent data, efficient emissions controls, and clear strategies for CO₂ reduction are central to this process. The report presents detailed results for Scope 1, 2, and 3 emissions, which form the basis for future sustainability measures.

FAL-CON HOLDING GmbH: Our path to determining our 2023 Corporate Carbon Footprint

Sustainability is a top priority for FAL-CON HOLDING GmbH. To further optimize our contribution to reducing greenhouse gas (GHG) emissions, we commissioned Green Vision Solutions GmbH to determine our Corporate Carbon Footprint (CCF) in 2023. This report represents the systematic recording and evaluation of our CO₂ emissions and forms the basis for targeted measures to reduce our ecological footprint.

The results at a glance:

Our emissions have been divided into three main areas:

- Scope 1 (direct emissions): 16.07 tons of CO₂e

- Scope 2 (indirect emissions from energy consumption): 37.38 tons of CO₂e (site-specific)

- Scope 3 (other indirect emissions along the value chain): 142.64 tons of CO₂e

Our total site-related GHG emissions amounted to 196,094 tons of CO₂e. This includes energy consumption, purchased goods and services, business travel, and employee commuting. Scope 3 accounts for the largest share and offers us the greatest opportunity to reduce emissions.

Why this is also relevant for you:

We've demonstrated that we know how it's done. Sustainability isn't just a project for us, it's a strategic advantage. With the insights from our corporate carbon footprint, we can take targeted measures to further reduce our CO₂ emissions while conserving resources.

And the best part? We can do it for you, too! Want to reduce your emissions while operating more efficiently? We have the expertise, the data, and the right tools. Contact us – together we'll find the optimal path to a more sustainable future.